Search | About Us | Guest Book

Search | About Us | Guest Book

|

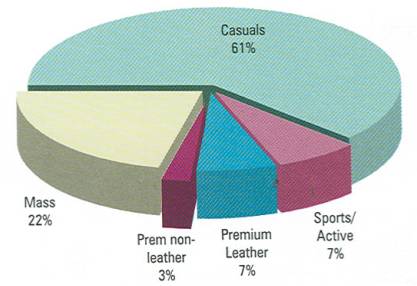

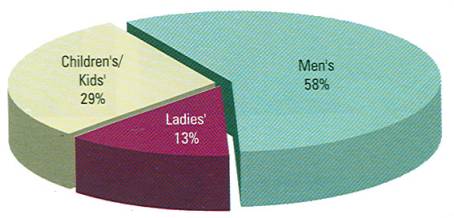

Indian Footwear Retail Industry Source: IMAGES F&R Research, INDIA RETAIL REPORT 2007 Footwear is a necessity to every person and at the same time is now a lifestyle as also a performance enhancement product; and is thus a segment with vast potential. The Indian footwear market is estimated to be worth Rs.13,750 Crore and constitutes just about one percent of Indian retail. About 37.8 percent of Footwear retail is in the organized segment, which qualifies it as the second most organized retail category in India, next only to Watches. Men's footwear comprises the largest share of the organized market accounting for about 52 percent in value terms. As footwear retailing in India has remained focused on men’s shoes, there exists a whale of opportunity in the exclusive ladies and kid’s footwear segment. This is especially surprising as women globally in line with global trends are the key decision makers for buying footwear. The ladies footwear segment still remains the most untapped as nearly 80-90 percent purchases happen in the unorganized market largely due to the dressing habits of women for whom consideration of durability or comfort are less important than colours and designs that go with dress. With the Indian woman becoming more brand-conscious as opposed to the past state of being product-conscious, more and more internationally renowned players are expected to enter the Indian market to fill this need-gap. Volume Share of Products Segments in Footwear

The children's and kids' segment also accounts for a significant share due to the increased emphasis on sporty looks. Given India’s very young population, the market for children’s footwear is also attractive for new organized players to enter and earn supernormal profits.

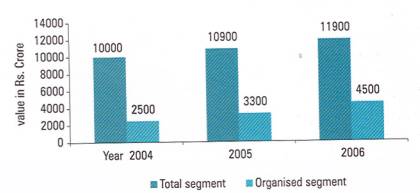

The footwear market today is showing a trend where more and more competitors within the segment are coming together and forming alliances through cross-promotions and tie-ups benefits for enhanced reach and offering the consumer access to a wider range of products and brands. The London-based Carlton group became the first overseas player to enter the Indian women’s footwear market when it set up its first store at the MGF Metropolitan Mall in Gurgaon recently. Growth of Indian Footwear Retail ( Value Rs. Crore at 2003-04 Prices )

The entry of specialty sportswear retailers such as Royal Sporting House, Sports Station and Planet Sports providing the best shopping experience for customers and a platform to showcase the world’s top sports and active lifestyle brands has transformed the organized retailing scenario in the country. Royal Sporting House has over 40 stores in India, many of which are placed in prime locations within shopping malls. It is the exclusive distributor of brands such as Mizuno, Caterpillar, TYR, Dunlop Sports and non-exclusive ones such as Reebok, Adidas, Nike and Skechers. Planet Sports, with 20 outlets in the country, is the licensee in India for leading sports brands such as Puma, Speedo, Converse and Wilson, among others. The sportswear market is the only sector in India that has the presence of all three top international brands. The year 1996 witnessed the entry of Nike, Reebok and Adidas that gave a new dimension to footwear and fashion retailing in the country. Playful promotion campaigns, world class merchandising and the internationally styled stores enthused consumers to go for an extra pair of shoes and a couple of extra Tee Shirts and add a little bit of sporty images to their lifestyle. In the face of increasing competition from leading multinational players, domestic footwear retailers have also woken up to the opportunity that the segment beckons and are realizing that exposure to shopping standards abroad have made Indian consumers demand the same formats and experience here. Responding to this challenge, major domestic players like Bata and Liberty have significantly transformed their retail formats to become more lifestyle- oriented and are positioning themselves as vibrant and contemporary Indian brands. In recent years the market has seen entry of a host of new domestic and foreign brands like Drish, Lotto, Lotus Bawa, Now, Oakridge, Royal Elastic, Sketchers, Teenage, Teva, Timberland and Vans. Fashionable brands like Stryde and Red Tape and MNC brands like Allen Cooper, Franco Leone, Gaitonde, Gucci, Guess, Lee Cooper, are further developing the market by creating new segments. Source: IMAGES F&R Research, INDIA RETAIL REPORT 2007 ------------------------------------------- 9 Feb, 2008

It is almost a year now that Indiaretailing has been echoing the fact that whatever is being said, heard, or seen about organised retail in India, the ‘opposite’ of that is equally true.

Organised and unorganised, steel carts in stores and push carts on roads, POS-generated bills and handwritten parchis, high-quality branded goods and fakes sold by nobodies… every business activity has a parallel identity in India. In their effort to put the best foot forward while balancing their steps on these seemingly endless dichotomies, Team Indiaretailing’s vigilant eye came upon some of the leading footwear brands that are being sold at throwaway prices in Sarita Vihar area in the NCR. Temporary kiosks and ragged racks have been set up in front of what used to be branded outlets, which were sealed by the Municipal Corporation of Delhi (MCD) a few months ago, tagged as ‘unauthorised construction’. The surprising makeshift arrangement in front of these closed shops primarily sells footwear, and on offer are almost all the known brands in India. Are they originals, counterfeits, or smuggled worthies? If they are counterfeits, who’s making them, and how dare anybody spoil the brand’s credibility? Do the brands know about this? Is it that brands are dumping their overproduced or defective products here? TI ventured into the hazy areas engulfing the issue. According to Images F&R Research, the Indian footwear market in 2006 was estimated to be worth Rs 13,750 crore. About 37.8 per cent of footwear retail is in the organised segment (Rs 5,200 crore at 2006 prices), and this qualifies it as the second-most organised retail category in India. The segment has seen over 100 per cent growth in the two years from 2004 to 2006. The statistics obviously did not have anything to reveal on the parallel markets. The more one tried understanding this parallel business, the more complicated it seemed to become. Hence, in the wisdom of the moment, TI here presents the picture as it emerges, and the sequence of activities and varied opinions that it came across, leaving the balancing and the understanding part to whosoever can understand better.

Indian Footwear Industry | Indian Leather Industry | Associated Organisations | Footwear Retail Industry |Footwear Manufacturers' Directory | Footwear Component Industry | Import & Export | Major Production Centers | Statistical Information |Brief Description of Industry | Global Statistics | Environmental News | Indian Ambition | Global Conferences | Footwear Dictionary| Recession Issues | Industry in a Nutshell | Question Answer Area | Footwear Industry News | Mailing List | Chat | Industry Related Archieves | Mobile Zone | Industry Events Info | Shoe Sizing Systems | Indian Ethnic Footwear | Human Resource | New Technological Developments | Employment Scenario | Global Footwear Industry | Other Resources | Search

|